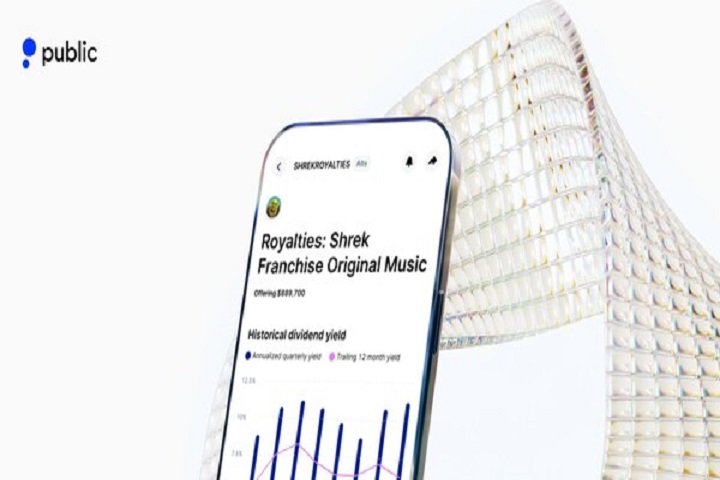

Investing Platform Public Launches New Alternative Asset, Music Royalties

Starting with original music from the “Shrek” film franchise, investors may receive quarterly dividends based on the consumption of “Shrek” films and musical tracks

NEW YORK, Oct. 3, 2023 /PRNewswire/ — Public, the investing platform that lets members invest in stocks, ETFs, crypto, Treasury bills, and alternative assets, announces the launch of music royalties on its alternative asset platform. Starting with a catalog of 768 composition tracks from the “Shrek” film franchise composed by Harry Gregson-Williams, investors may be able to further diversify their portfolios with a cash-flow-producing asset that can pay quarterly dividends. While royalties, like all investments, carry some degree of risk, these assets have a low correlation with stocks, bonds, and other traditional investments, which means they can help reduce portfolio volatility and increase risk-adjusted returns.

As of July 2023, the Shrek franchise is the second highest-grossing animated franchise, with over $4 billion in box office revenue. Launching with the franchise, a music library spanning hundreds of songs across multiple media properties, means earnings for retail investors are not reliant on a single song. After 20 years, the film has broad cross-generational appeal and still plays a role in popular culture, potentially making it a timeless asset class.

The asset generates royalties when Shrek films (Shrek, Shrek 2, Shrek the Third, and Shrek Forever After, and the TV special Shrek The Halls) air on television, are streamed, or are used in other broadcast programming, or anytime the music plays on a Shrek theme park ride. Investors will receive royalties as quarterly dividend payments.

The initial offering for shares in the entity holding the Shrek royalty interest is $889,700, with 88,970 shares available at $10 per share. Retail investors can invest on the October 5, 2023 mini IPO date**, at 10 am ET. After investing, shareholders can earn dividends from the royalties generated by the consumption of the content. While dividend payments are not guaranteed, will fluctuate based on content consumption, and may not be paid at all, the asset generated an 8.5% dividend yield from 2022 royalties and an 8.33% dividend yield from 2021 royalties.*

“Investors are increasingly looking to diversify across asset classes, from stocks to collectibles to royalties,” said Keith Marshall, GM of Alternatives at Public. “By launching royalties, we are excited to give investors another asset class to build a multi-asset portfolio that can generate passive income.”

Learn more about royalties: public.com/royalties

About Public

Public is an investing platform that allows everyone to invest in stocks, treasuries, ETFs, crypto, and alternative assets, like fine art and collectibles—all in one place. We help people be better investors with access to custom company metrics, live shows about the markets, and insights from a community of millions of investors, creators, and analysts. Learn more at www.public.com.

Disclosures

Brokerage services for securities issued pursuant to Regulation A of the Securities Act of 1933 are offered through Dalmore Group, LLC (Dalmore), member FINRA & SIPC. Alternative assets are self-custodied and are not covered by SIPC. Alternative assets are speculative, involve substantial risks (including illiquidity and loss of principal). The issuers of these assets may be an affiliate of Public, and Public (or an affiliate) may earn fees when you purchase or sell these securities. Available to US members only. Additional info at public.com/disclosures/alts-risk-and-conflict-of-interest-disclosure

This offering is made in reliance on Regulation A under the Securities Act of 1933. The securities offered are speculative, illiquid, and an investor could lose the entire investment. Investors should read the relevant Offering Circular and consider the risks disclosed therein before investing.

* Stated figures represent royalties paid with respect to calendar years 2022 and 2021. Percentages were calculated by dividing historical 12-month royalty earnings less 10% fees (but excluding all taxes) by offering amount of $889,700. Source: Royalty Exchange Inc. Past performance is no guarantee of future results.

**A mini IPO is a Regulation A+ offering.

Disclaimer

IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. REGULATION A OFFERINGS ARE SPECULATIVE, ILLIQUID, AND INVOLVE A HIGH DEGREE OF RISK, INCLUDING THE POSSIBLE LOSS OF YOUR ENTIRE INVESTMENT.

Public Shrek Royalties LLC is offering securities through the use of an Offering Statement that the Securities and Exchange Commission (‘SEC”) has qualified under Tier II of Regulation A. While the SEC staff reviews certain forms and filings for compliance with disclosure obligations, the SEC does not evaluate the merits of any offering, nor does it determine if any securities offered are “good” investments.

This profile may contain forward-looking statements and information relating to, among other things, the company, its business plan and strategy, and its markets or industry. These statements reflect management’s current views regarding future events based on available information and are subject to risks and uncertainties that could cause the company’s actual results to differ materially.

Investors are cautioned not to place undue reliance on these forward-looking statements as they are meant for illustrative purposes, and they do not represent guarantees of future results, levels of activity, performance, or achievements, all of which cannot be made.

Moreover, although management believes that the expectations reflected in the forward-looking statements are reasonable, neither Public Shrek Royalties LLC nor anyone acting on its behalf can give any assurance that such expectations will prove to have been correct nor do they have a duty to update any such statements to conform them to actual results. By accessing this site and any pages on this site, you agree to be bound by our Terms of Use and Privacy Policy, as may be amended.

SOURCE Public